Proposer / Builder Separation (PBS)

MEV, Block Building and Beyond

The democratization of MEV extraction in Ethereum Post-Merge is a massive opportunity and will create an entire new market and an entire new specialized and professional role in the blockchain ecosystem.

The key to this new market:

Minimize MEV for the user

Maximize MEV for the validator

Proposers: may want to to sell blockspace.

Builders: want to buy blockspace.

What if you could sell block space to rebates to businesses? How would it change how users select their infrastructure provider What if you could provide wallet user incentives in the form of rebate for forwarding transactions to be validated with the optimum amount of value?

Sounds like a very low level, infra related thing that might not be in reach of those without a bunch of compute… But what if that wasn’t the case?

The AdTech Industry

The AdTech industry was built this concept of being able to have your transaction ordered and placed ahead of other bids to be included in front of your prospective buyer.

The supply chain whitespace was filled by adtech companies and the market gave rise to many different businesses serving the needs of ad servers, exchanges and platforms. An entire multibillion dollar ecosystem was born.

Though this became a massive business dominated by 95% by Facebook and Google, until that point there was major arbitrage opportunities for those who knew the adtech supply chain at a super low level and knew how to extract value from the set.

How does this relate to MEV and Crypto…?

Back to crypto. What if you can guarantee to users that they will have their transactions included in the maximum value way, not frontrun etc and even guarantee certain rebates back to them if they use your service to send transactions on the network?

This is all possible in a new concept called block building which is built on the concept of PBS (Proposer / Builder Separation). Listen to this for an excellent overview:

https://www.galaxy.com/research/podcasts/galaxy-brains/ep-24-flashbots-and-mev-featuring-stephane-gosselin/

It is an entire new supply chain and set of actors that are going to create, relay and validate transactions on the Ethereum network.

PBS splits the responsibilities of PoW miners (PoS validators) into two roles:

Block Building and Block Proposal.

Block Builders will be able to build certain blocks, or sets of transactions, in an ordered list and using mev-boost they will be able to compete in the market for sending transactions.

Block builders are specialists who accept transactions from users and searchers (either directly from private order flow or the public mempool), and try to build the most profitable block possible from those transactions.

The builders are the brains, they are ordering transactions in a way that extracts the most value from transaction fees and MEV.

Searchers are looking for abritrage and sending bundles of transactions to an aggregator.

Why the most profitable? Well, the relayers have incentives to process the most valuable block which would be comprised of the blocks txn fees and the reward split of the coinbase transaction. So if one block builder x proposes taking 15% of the block reward and block builder y proposes taking 10% of the block reward; well the relayer is going to make the most profitable decision. Basically, each slot the proposer can query for all of the block bids and choose the most profitable.

The key to this democratization is an open source software called mev-boost.

mev-boost is piece of open source software built by Flashbots. mev-boost is a trusted form of PBS implemented post-merge where builders submit blocks to a trusted entity (or entities) called relays. mev-boost is an off chain implementation of PBS. You can think of it as there is a market of relays, mev-boost is a relay multiplexer.

Proposers: may want to to sell blockspace.

Builders: want to buy blockspace.

How can we facilitate this exchange?

Relays are responsible for aggregating blocks from builders and figuring out which block is the most profitable, which is ultimately what is sent to validators to be signed and what gets included on the blockchain. Relays are a trusted intermediary that ensure (compute the bid) that builders only provide good blocks (check the validity) and that the block data is made available (store the block).

Relays are like an escrow mechanism in that both block builders and proposers both have to trust the relay.

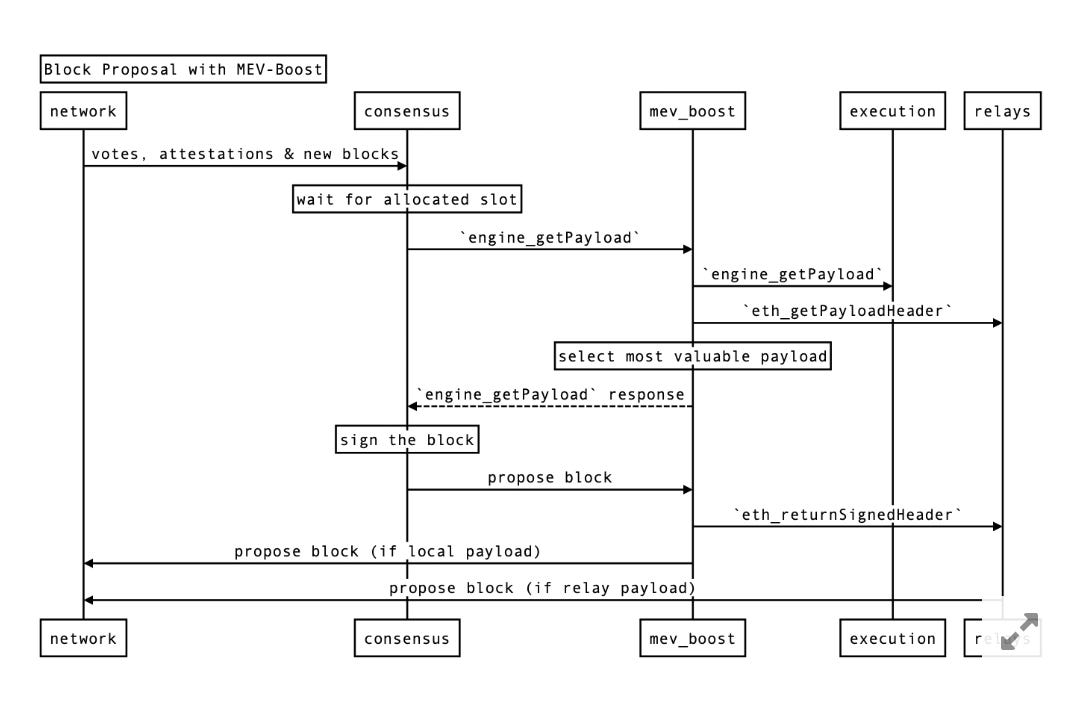

So every 12 seconds there is a sort of auction / exchange:

Block Builder sends a Block to Relay

Relay sends the only the block header and bid value to the proposer

The proposer selects the bid

The proposer signs that header

The proposer sends the signed header back to the relay

The relay sends the block and the bid to the proposer

The proposer sends the block to the rest of the network.

Where does this block data come from?

As a searcher on PoS Ethereum, your primary concern regarding PBS is sending your transactions / bundles to the right builder. They are collecting transactions and creating new permutations of these transactions in order to extract value.

If builders can make a block that is significantly more valuable than a block created be a proposer than the proposer would not want to miss out on that revenue. So they will opt in to using blocks built by builders. They will be specialized actors that are focused on delivering the most maximum valued order of transaction. Hummingbot algos will provide an efficient marketplace for blockspace.

Builders, and the relays they connect to, will be able to see your transactions before they're included (which means they can front-run, censor, etc), so it's important to choose builders that you trust. In a L2 execution system, the sequencer is the builder as they construct rollup payloads to submit to the L1. Similar systems to mev-boost will provide a more robust and decentralized set of sequencers.

Distributed Builders could also be used to build blocks. Could you run a blockchain network that builds an ordered set of transactions and then once aggregated sends those transactions. Can we have 30 second finality on Ethereum but with a subsecond distributed builder network? Many thousands of participants in a distributed builder could more easily be trusted by searchers, be more censorship resistant and have 500ms 1 second block time layer using Tendermint.

Users and Searchers may soon be asking:

What is the most trusted supply chain for this transaction? What is the most cost efficient supply chain for this transaction? What is the most private supply chain for this transaction? In a perfect world the value is accrual is to the users and the network. MEV generated by users is returned to users in the form of rebates, txn fee subsidies or other advancements.

While it doesn't directly impact searchers, it should also be noted that mev-boost is the component that enables validators to plug into the PBS builder network; it chooses the most profitable block from multiple relays. Though, PBS will be eventually be integrated into Ethereum natively. This will eliminate the need for trusted relays. The more a block is worth (transaction fees + MEV), the more likely it is to win the slot auction and be included on-chain. The market for capitalizing on MEV is shifting to an open and lucrative democratization by injecting a new set of relationships between agents into the ethereum network and mempool infrastructure and greater ecosystem.

users —> searchers —> builders —> relays —> mev-boost —> validators.

the block production chain:

User has intent, they see the state space differently and want to act on it. In order to do so they need a bridge to communicate this in the form of an interface.

The user uses an interface (web3) to send transaction to the public mempool.

Searcher observes mempool creates a bundle of intent in the form of transactions.

Builder creates block full of transactions

Relayer creates the block header

Proposer proposes the block ans the chain

At every level there is some form of censorship resistant.

Builder censorship can be solved by encryption and inclusion lists. Inclusion list would enforce that certain transaction types are inlcuded in blocks built by builders. It could also initially be altruistic self building. No censorship and no sandwhiches. 32 Eth self validator running Geth. Solo Validators will have the same visibility as pools.

What is the value that each actor contributing? What are potential collusion risk, cooperation risks between proposers, relays, builders?

We will need trusted relayer services.

Ways to improve?

Payload Validation committees or SNARKs for validity proofs

Bid / Payment Validation: Payment proofs

Payload Availability: Data availability committees.

User intent on how they want to see the state of the blockchain can now be directly monetized. Aggregating searcher transaction bundles, capturing the maximum value, proposing the most profitable blocks.

Searchers and Specialized Searcher is really good at Uniswap and Sushiswap Arbitrage Bundle Requirements are that you have to include my bundle at the beginning of the block, this is what I want the state to be before I include these bundles etc.

Future Mechansims

In the future, encrypted mempools could introduce another layer of complexity around mev extraction. This also could prevent the risk of censorship if one block builder becomes so good at block building that they are proposing a high percentage of blocks. Partial block auctions could also solve this as well.

Trusted HSM cab be used, searchers send their bundles to threshold key. Along with access list and a ZKSNARK of correctness.

Searchers send encrypted bundles. Aggregator runs merge algo inside TPM. Construction can be done by solo-validators.

Block builders can specialize, there will be all sorts of new block types:

Max Profit

Non-Malicous Block

Reg Compliance

Green Blocks

Fair Ordered

You may find that one builder is more or less friendly to your strategy, your values, your communities values; than others. Builders are competing with each other, so they are all incentivized to include your bundles in their blocks.

MEV Smoothing is redistribution of MEV extracted. Th

Encrypted mempool. Encrypted off-chain. Encrypted transaction included on chain, Decrypted and then executed all in 1 slot.

This is the future of the public blockchain market for transactions and a giant opportunity for not only infrastructure providers, but dapps, wallets; everything will be affected by this post-merge (in less than a month) mev democratization.

More Low level MEV, questions / risks?

Fees collected per unit time in the state space. Fees times expertise. Running a relay IS a Physical, Geographical diversity and Competitiveness factor. Open sourcing infrastructure. Can you increase the cost of MEV extraction, more efficiently capture the MEV.

What about new markets that allow for leveraging the root premise that MEV is built on which is that as a validator if you double sign a header you will be slashed.

Slashing exists in POS. Eigenlayer, Ethereum Restaking Collective, is building this opt-in DA layer which could allow for Validators to put their staked Eth at additional risk for some reward. It could allow for novel mechanisms with builders and proposers could both contribute in the market for proposing bundles which can be sent to the network.